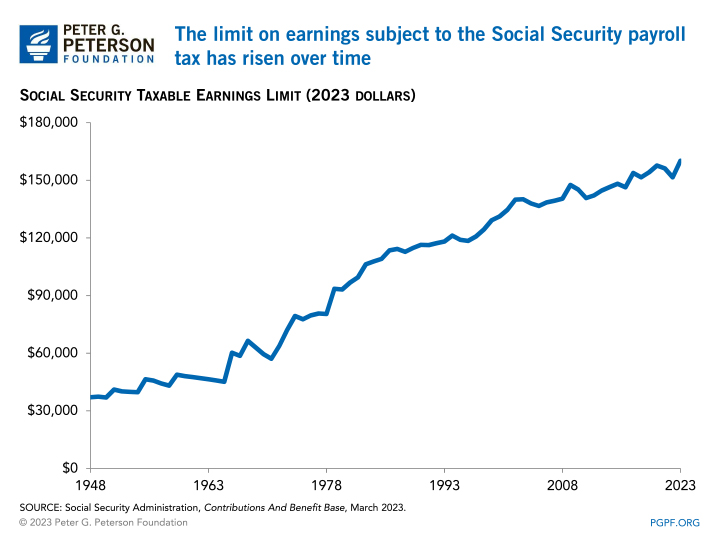

Wage Cap Allows Millionaires to Stop Contributing to Social Security on February 24, 2022 - Center for Economic and Policy Research

Scrap the Cap: Strengthening Social Security for Future Generations – Social Security Works – Washington

Social Security Administration Announces 2022 Payroll Tax Increase | ERI Economic Research Institute

:max_bytes(150000):strip_icc()/social_security_card-157422696-5c607e6046e0fb00014422ac.jpg)

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)