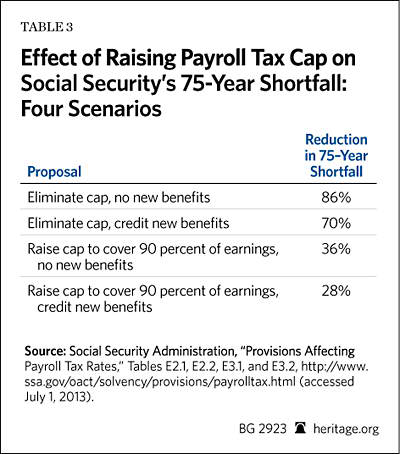

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

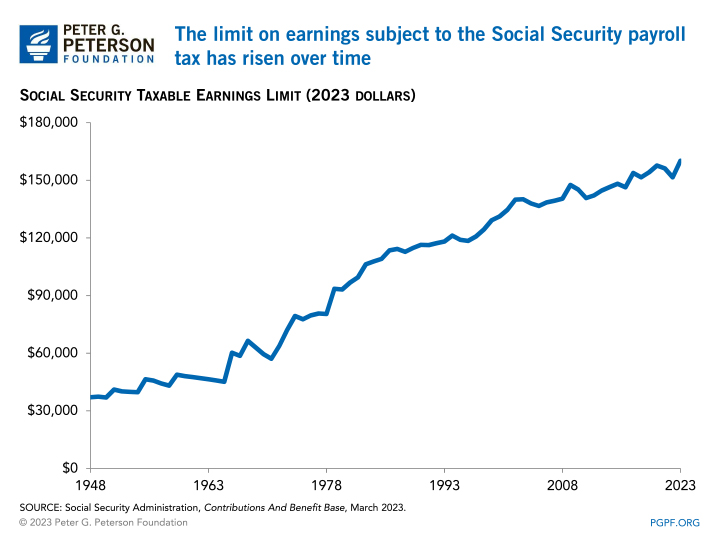

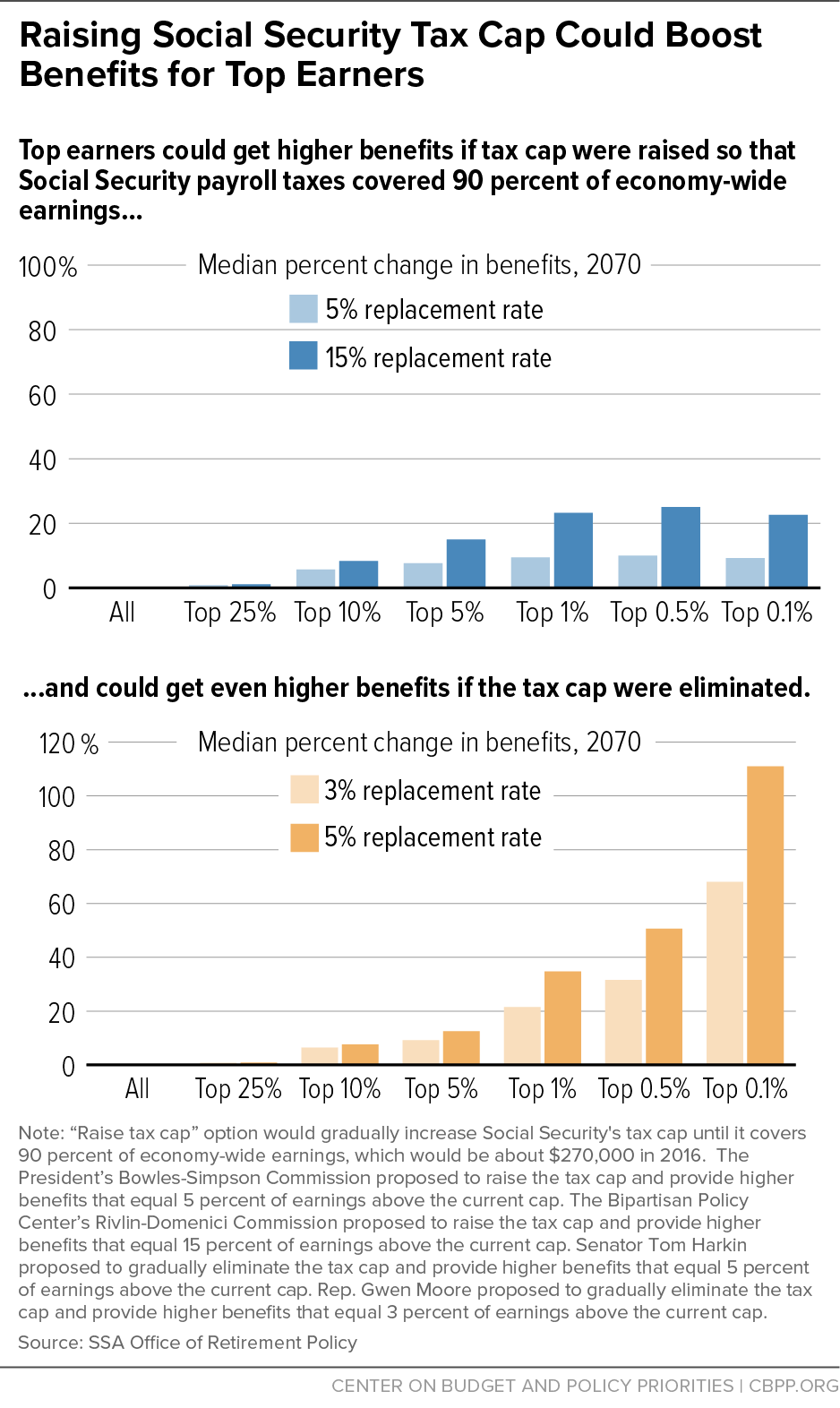

Department of Selective Charts: Social Security Tax Cap Division | American Enterprise Institute - AEI

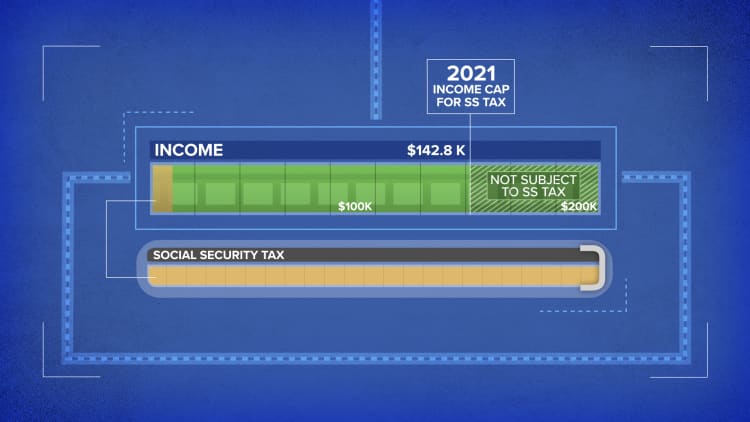

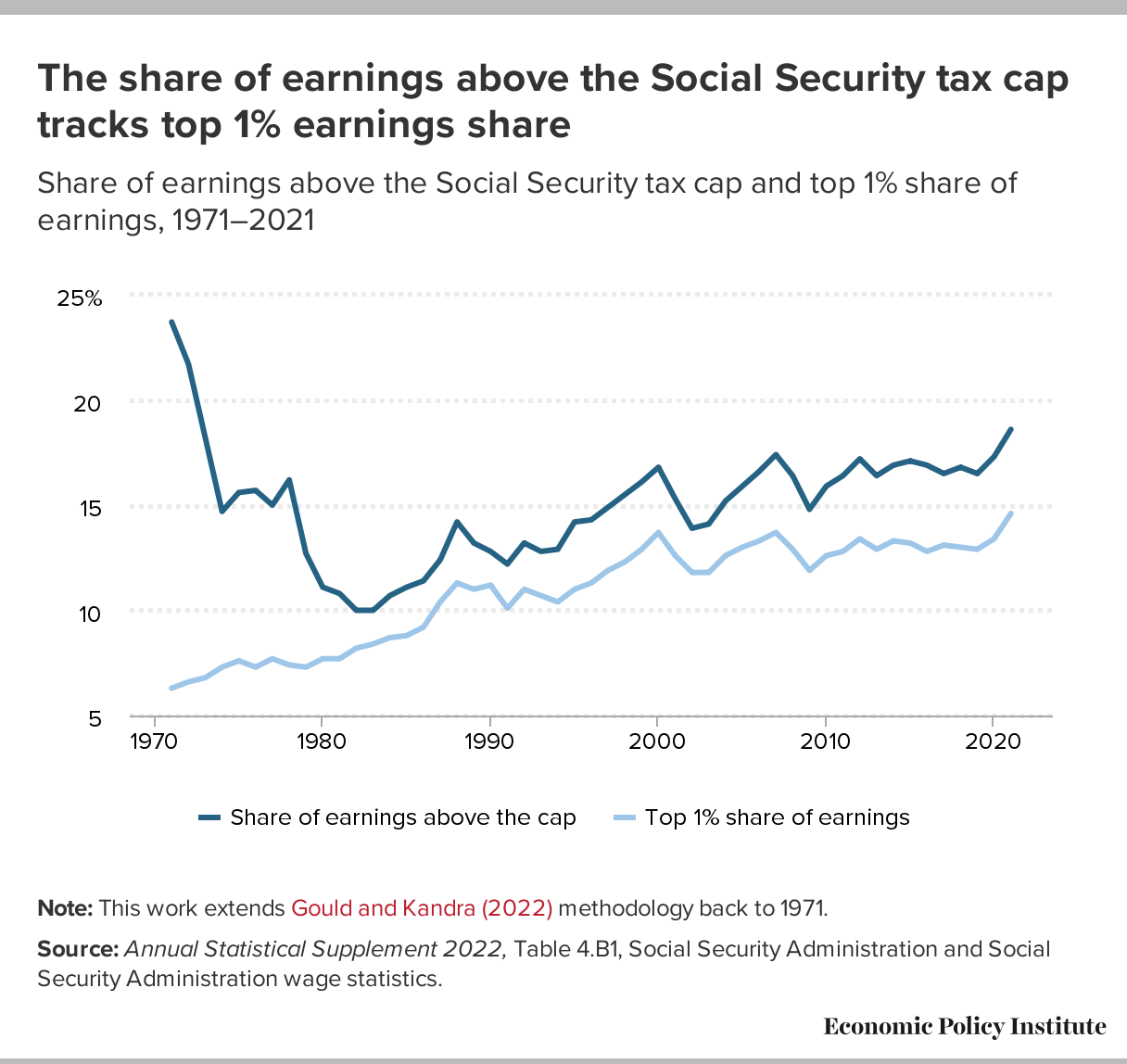

Unfair Cap Means Millionaires Stop Contributing to Social Security on February 28, 2023 - Center for Economic and Policy Research

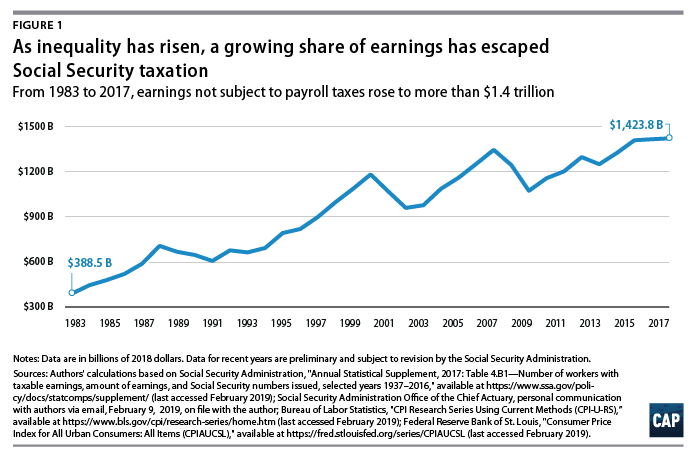

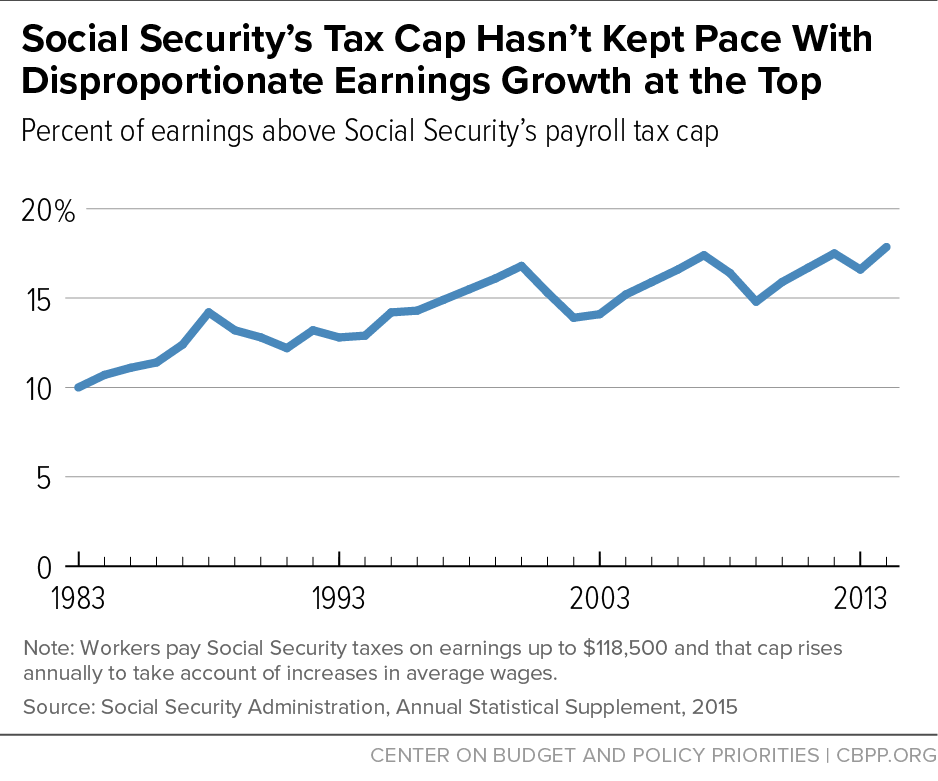

A record share of earnings was not subject to Social Security taxes in 2021: Inequality's undermining of Social Security has accelerated | Economic Policy Institute